| 1 | : | What is SmartLink2u PrePaid MasterCard® all about? |

|

| This is a PrePaid Mastercard® that you can use to purchase goods just like a credit card but with spending limited to the amount of money you place on the card - like your prepaid phone card. |

|

| 2 | : | What do I need to do? |

|

| - Buy the SmartLink2u PrePaid MasterCard® Starter Pack

- Sign your name on signature panel on reverse of card

- Register

|

|

| 3 | : | How do I use it? |

|

| Just present it to the outlets where MasterCard® cards are accepted and it will be inserted into an EDC terminal (credit card terminal) for approval, just like a normal credit card transaction. |

|

| 4 | : | Where can I use it? |

|

| Worldwide where MasterCard® is accepted. |

|

| 5 | : | What do I need to do before I can use it? |

|

| Submit the registration form in your Starter Pack, along with a photocopy of your NRIC (both side)/passport to any AmBank branch OR fax to 03-2164 0497 OR mail to AmBank Card Centre.

|

|

| 6 | : | Who can qualify for this card? |

|

| Unlike regular credit cards, your acceptance is not determined by your income, so anybody over the age of 12 with a National Registration Identity Card (NRIC)/Passport qualifies. |

|

| 7 | : | Where and how can I "Top-up"? |

|

| - Using cash at AmBank Branches:

- Over-The-Counter; or

- Cash Deposit Machines - AmAssurance Branches

- "Top-up" centres where you see the NexG Recharge logo (i.e. e-pay stations)

- Fund transfer (if you have an AmBank account) via ATM or online at www.ambg.com.my

- Interbank Giro from your other bank accounts

|

|

| 8 | : | How much can I top-up? |

|

| You can top-up in denominations of RM30, RM50, RM100, RM200, RM300, RM400 and RM500 at any location you see with NexG™ Recharge logo (participating e-pay outlets), via AmBank Cash Deposit Machines and internet banking. You can reload up to a maximum available balance not exceeding RM10,000 at anytime given.

Note: The minimum top-up is RM100 over the counter at AmBank Branches. |

|

| 9 | : | Can I withdraw cash from the Card? |

|

| Yes. A PIN will be sent to you approximately 3 weeks upon registration which will allow you to withdraw cash FREE with no fee imposed, from any AmBank ATMs at over 180 branches nationwide. |

|

| 10 | : | How do I keep track of my spending? |

|

| Statement of account is available via ambankgroup.com |

|

| 11 | : | How much can I spend per transaction? |

|

| You can spend up to RM2,000 per transaction. |

|

| 12 | : | Can I use my Card at petrol stations? |

|

| The Card can be swiped at the self-service terminal. However, an amount of RM200* would be withheld in order to allow the requested transaction. Some merchants such as hotels and car rental services are authorised to hold/reserve some amount of money. The difference between the withheld amount and the actual transaction amount will be released to your account, no later 30 days. Alternatively, you may swipe your Card at the terminal inside the store instead of swiping your Card at the petrol pump island.

This is a standard industry practice. |

|

| 13 | : | What other benefits can I enjoy? |

|

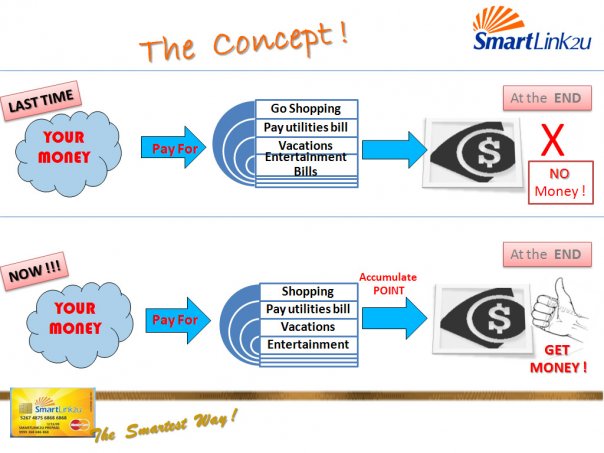

| Besides the cash free convenience, you will be rewarded with bonus points, discount vouchers, FREE RM10,000 Personal Accident (PA) Insurance and other privileges. |